After posting new all time high the Index witnessed correction and kissed 6150 level. After continuous fall from higher level the Index today took pause and showed some sign of consolidation and gave a flat close. Nifty has a next support around 6135 level and considering today's move we expect the Index to witness bounce from here. Though the trend is Negative, in light of the facts mentioned we would recommend to Buy 6200 CE at 64 with the SL of 50 TGT 85-90 in a short term.

About Me

- DEV ADVISORY SERVICES

- NISM Certified Research Analyst & Mutual Fund Distributor.

Monday 16 December 2013

Thursday 15 August 2013

NIFTY UPDATES 15813

AS PER THE OPTION CHAIN 5700 PE IS NOW HAVING HIGHEST OI OF ALMOST 64 LAC WITH HUGE ADDITION OF 18.27 LAC. 5700 CE IS HAVING OI OF49.9 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 51.84 LAC AND 36.46 LAC RESPECTIVELY. 5900 CE IS HAVING HIGHEST OI OF 64.53 LAC. VIX CLOSED IN RED AND NOW CONSECUTIVELY CLOSING BELOW 20 LEVEL. SO IT SEEMS THAT BULLS ARE HAVING VERY TIGHT GRIP ON 5700 LEVEL WHICH IS NOW GOING TO ACT AS MAJOR SUPPORT FOR NIFTY. 5900 ON THE UPPER SIDE IS THE IMMEDIATE STRONG RESISTANCE. AS MENTIONED IN OUR EARLIER POST 5763 IS THE RESISTANCE WHICH ONCE CROSSED NIFTY CAN KISS 5815-5830 LEVEL. THE BIAS IS STILL BULLISH AND BEING RATIONALE TRADER ONE MUST STAY WITH THE TREND. THE BEST STRATEGY AT THIS JUNCTURE SHOULD BE BUY ON EVERY DECLINE UNLESS AND UNTIL 5692 IS BROKEN.

Tuesday 13 August 2013

NIFTY UPDATES 13813

AS EXPECTED NIFTY MOVED 1.5% TODAY AND FORTUNATELY NORTHWARDS.. :) NIFTY FOUND A STRONG SUPPORT AROUND 5460 AND TODAY THE BOUNCE WAS CAPITALIZED. AS PER OPTION CHAIN HEAVY LIQUIDATION WITNESSED IN 5200,5300 AND 5400 PE STRIKES INDICATING PROFIT BOOKING BY THE BULLS. 5600 PE ADDED ALMOST 12 LAC IN OI TAKING TOTAL OI AT 52.26 LAC SUGGESTING 5600 EMERGING AS SUPPORT . TOTAL OI AT 5700 CE AND 5700 PE IS 46 LAC AND 45.69 LAC. SO WE ARE HAVING EQUAL OI AT 5700 STRIKE FOR WHICH WE MAY SEE FIGHT. 5800 CE IS HAVING OI OF 53.71 AND 5900 CE IS HAVING OI OF 61.55 LAC. 5800 PE IS HAVING TOTAL OI OF 30.59 LAC. SO 5800 REMAINS IMMEDIATE RESISTANCE. VIX WAS DOWN BY ALMOST 10% AND CLOSED BELOW 20 MARK. SO THE BIAS IS SLIGHTLY IN FAVOR OF BULLS NOW. RESISTANCE FOR NIFTY IS 5763. ON THE DOWN SIDE 5660-5630 WILL ACT AS SUPPORT.

Monday 12 August 2013

NIFTY UPDATES 12813

IN TODAY'S SESSION NIFTY BROKE 5630 ON INTRADAY BASIS BUT FAILED TO SUSTAIN AT HIGHER LEVELS AND FINALLY CLOSED AT 5612 AND FORMED A DOJI CANLESTICK ON A DAILY CHART. AS PER OPTION DATA 5400 PE IS HAVING THE HIGHEST OI OF 70.7 LAC. OI AT 5500 PE IS ALMOST 60 LAC WHEREAS OI AT 5500 CE IS 23.17 LAC. OI AT 5600 CE IS 42.98 LAC WHEREAS AT 5600 PE IS 41.76 LAC. 5700 CE IS HAVING OI OF 48.47 LAC WHILE 5700 PE IS HAVING OI OF 42.86 LAC WITH ADDITION OF 3.42 IN OI. THE INTERESTING FACTOR IS THAT 5700 PE IS HAVING HIGHER OI THAN 5600 PE. VIX CLOSED IN GREEN AT 21.28 MARK. SO THE CONFUSION HERE IS AS TO WHETHER 5700 PE WITNESSED WRITING OR BUYING? HOWEVER WITH NIFTY CLOSING BELOW 5630 WITH FORMATION OF DOJI WE SENSE 5700 PE MUST HAVE WITNESSED BUYING. THE OTHER REASON TO SUPPORT THE VIEW IS THAT 5700 PE STRIKE IS IN THE MONEY AND WRITING NORMALLY IS NOT PREFERRED IN IN THE MONEY OPTIONS. IF IT IS VICE-VERSE i.e. WRITING IN 5700 PE MARKETS MAY MOVE BEYOND 5700. IN A NUTSHELL THE DATA IS CONFUSING BUT AT LEAST WE CAN CONCLUDE THAT EITHER SIDE A BIG MOVE IS ABOUT TO HAPPEN IN A DAY OR SO. SO TRADERS MUST BE VERY CAUTIOUS NOW.

Friday 9 August 2013

NIFTY UPDATES 9813

NIFTY IS NOW FINDING SUPPORT AROUND 5470 ZONE. AS PER OPTION CHAIN 5400 PE IS HAVING HIGHEST OI OF 68.21 LAC. OI AT 5500 CE AND 5500 PE IS 23.35 LAC AND 50.54 LAC. 5600 CE IS HAVING OI OF 45.62 LAC AND 5600 PE IS HAVING OI OF 34.75 LAC. 5700 CE IS HAVING OI OF 49.48 LAC WITH HUGE ADDITION OF 10.39 LAC IN OI. VIX CLOSED DOWN BY ALMOST 4% AT 21.19. SO ON THE DOWNSIDE 5500 IS THE IMMEDIATE SUPPORT WHEREAS 5700 REMAINS A TOUGH RESISTANCE. AS PER THE DATA IT SEEMS MARKETS MAY CONSOLIDATE IN A RANGE OF 5500-5650. ON THE UPPER SIDE 5630 MAY ACT AS IMMEDIATE STRONG RESISTANCE.

Wednesday 7 August 2013

NIFTY UPDATES 7813

NIFTY IS NOW CLOSING BELOW ITS UPTREND LINE FOR THE LAST COUPLE OF SESSIONS AND STILL THE MARKETS ARE SHOWING NO SIGN OF RECOVERY. AS PER OPTION CHAIN HUGE OI WAS BUILT UP TODAY AT 5400 PE AND TOTAL OI REACHED 76.6 LAC. 5500 CE AND 5500 PE IS HAVING OI OF 22.61 LAC AND 52.25 LAC. 5600 CE IS HAVING OI OF 40.16 LAC. VIX CLOSED IN RED TODAY AT 22 LEVEL. SO THE IMMEDIATE RANGE OF NIFTY SEEMS TO BE 5400 TO 5600. SINCE THE TREND IS STILL DOWN INVESTORS ARE REQUESTED TO STAY SIDELINE UNLESS MARKETS CONSOLIDATE RATHER THAN JUMPING TO CATCH THE FALLING KNIVES.

Sunday 4 August 2013

NIFTY UPDATES 4813

ON A DAILY CHART NIFTY HELD 5670 LEVEL ON A CLOSING BASIS AND FOUND SUPPORT AROUND ITS UPTREND LINE. THERE IS NO DOUBT THE PREVAILING TREND OF THE NIFTY IS DOWN BUT WHAT MADE US STILL MODERATED BULLISH ON THE INDEX IS THE DATA SUGGESTED BY DERIVATIVES CHAIN AS 5700 PE IS STILL HAVING OI OF 62.48 LAC WHEREAS 5700 CE IS HAVING OI OF 29.85 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 43.43 LAC AND 38.64 LAC. OI AT 5900 CE IS 49.41 LAC. VIX CLOSED ABOVE 20. SO STILL IT SEEMS THAT 5700 IS NOT BROKEN CONVINCINGLY AND 5800 SEEMS TO BE VULNERABLE. ON THE DOWN SIDE NIFTY HAS A VERY STRONG SUPPORT AT 5630 LEVEL WHICH ONCE BROKEN WE WOULD ADVISE TO EXIT OUR BULL SPREAD STRATEGY GIVEN EARLIER. ON THE UPPER SIDE 5770-5815 IS GOING TO ACT AS RESISTANCE.

Thursday 1 August 2013

NIFTY UPDATES 1813

IN TODAY'S VOLATILE SESSIONS NIFTY AGAIN POSTED SWING LOW OF 5676 AND WITNESSED BOUNCE BACK. JUST A SESSION AGO NIFTY FORMED A DOJI AND TODAY' CANDLE INDICATES A CLEAR IN-DECISION. AS PER OPTION CHAIN 5700 PE IS HAVING OI OF 64.55 LAC WITH ADDITION OF 5 LAC IN OI. TOTAL OI AT 5800 PE AND 5800 CE IS ALMOST EQUAL. OI AT 5900 CE IS 42 LAC AND AT 6000 CE IS 63 LAC. VIX ROSE BY MORE THAN 5% AND JUST CLOSED BELOW 20 MARK. SO BEARS ARE TRYING VERY HARD TO HOLD 5700 LEVEL AND A TOUGH FIGHT FOR 5800 WILL CONTINUE. LOOKING AT THE DATA WE ARE SLIGHTLY BULLISH ON THE MARKET WITH SL OF 5675 AS 5900 STILL SEEMS TO BE VULNERABLE IF 5815 IS CROSSED ON CLOSING BASIS. 6000 REMAINS A STIFF RESISTANCE MARK AS OF NOW. THE ONLY FACTOR RAISING CONCERN IS THE VIX.

WE RECOMMEND TO TRY BULL SPREAD STRATEGY

BUY 5700 CE AT 151 AND SELL 5800 CE AT 94

PREMIUM PAID 57 SL 25 TGT 95-100

Wednesday 31 July 2013

NIFTY UPDATES 31713

AS MENTIONED IN OUR EARLIER POST NIFTY FOUND SUPPORT AT 5700 LEVEL, IT FILLED THE GAP AROUND 5680 AND WITNESSED A BOUNCE BACK. 5700 PE IS HAVING HIGHEST OI OF 59 LAC SUGGESTING THAT IMMEDIATE SUPPORT PLACED 5700 MARK. 5800 CE AND 5800 PE IS HAVING OI OF 31.5 LAC AND 37.65 LAC. TOTAL OI AT 5900 CE IS 36.82 LAC. NIFTY FORMED A DOJI AFTER CONTINUOUS HAMMERING. VIX CLOSED UP BY 3.6% AT 18.77. SO IN SESSIONS AHEAD TOUGH FIGHT FOR 5800 MARK IS EXPECTED BETWEEN BULLS AND BEARS. NOW ALL EYES ON THE FOLLOW UP MOVES AFTER THE DOJI AFTER WHICH A CLEAR VIEW ON THE INDEX CAN BE FORMED.

RESISTANCE 5760-5795-5815

SUPPORT 5710-5680

Tuesday 30 July 2013

NIFTY UPDATES 30713

NIFTY BREACHED A CRUCIAL SUPPORT PLACED AROUND 5815 AND CLOSED AT 5755 AFTER TESTING 5747 LEVEL. HUGE OI BUILT UP TODAY AT 5700 PE OF 18 LAC TAKING THE TOTAL OI TO 54.6 LAC. TOTAL OI AT 5700 CE IS 7.55 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 29.12 LAC AND 47.7 LAC. OI AT 5900 CE IS 44 LAC AND AT 6000 CE IS 56.79 LAC. 5900 PE IS HAVING TOTAL OI OF 36.79 LAC WITH LIQUIDATION OF 4 LAC. VIX CLOSED IN RED AND JUST MANAGED TO CLOSE ABOVE 18 MARK. CONSIDERING THE DATA IT SEEMS THAT 5700 IS GOING TO ACT AS STRONG SUPPORT FOR NIFTY. NO LIQUIDATION WAS SEEN AT 5800 PE WHICH IS QUITE SURPRISING. THOUGH THE OVERALL TREND OF THE INDEX SEEMS TO BE DOWN, BASED ON THE DATA WE ARE OF THE OPINION THAT BEARS MAY TAKE PAUSE AND THE INDEX MAY CONSOLIDATE.

Saturday 27 July 2013

NIFTY UPDATES 27713

AS PER OPTION CHAIN HIGHEST OI IS BUILT UP AT 5800 PE OF 45 LAC. TOTAL OI AT 5900 CE AND 5900 PE IS 32 LAC AND 41 LAC. 6000 CE IS HAVING HIGHEST OI OF 45 LAC WITH HUGE ADDITION OF 11.8 LAC IN OI. VIX CLOSED JUST BELOW 17 MARK AT 16.78 LEVEL. TECHNICALLY NIFTY FOUND A SUPPORT IN 5860 ZONE. AS OF NOW IT IS VERY DIFFICULT TO FORM A VERY CLEAR VIEW ON NIFTY. HOWEVER CONSIDERING THE FACTS THAT NIFTY WOULD BE TRADING AROUND SUPPORT ZONE AND HIGHER OI AT 5900 PE THAN THAT OF 5900 CE A POSSIBLE BOUNCE BACK CAN'T BE RULED OUT. TRADERS MUST STICK TO STOCK SPECIFIC MOVES.

SUPPORT 5860-5815

RESISTANCE 5910-5935

Monday 22 July 2013

NIFTY UPDATES... 22713

NIFTY IS NOW SUCCESSFULLY HOLDING 6000 LEVELS AND TRADING IN MULTIPLE RESISTANCE ZONE. AS PER OPTION CHAIN 5900 IS THE WALL OF SUPPORT AND IMMEDIATE SUPPORT IS 6000 WHEREAS 6100 ON UPPER SIDE REMAINS RESISTANCE. AS WE ARE APPROACHING JULY EXPIRY BULLS WILL TRY TO CLOSE THE NIFTY ABOVE 6050 LEVEL WHICH IS THE MONTHLY RESISTANCE. NIFTY IS IN AN UPTREND AND THE BEAUTY OF THE RALLY IS THAT IT IS NOT BEING LED BY THE BANKING SPACE. MARKETS ARE STRONGLY RESPONDING TO ANY POSITIVE NEWS AND ALL THE NEGATIVES ARE COMPENSATED OR SET OFF IMMEDIATELY BY SPECIFIC HEAVY WEIGHTS. VIX TOO HAS CLOSED BELOW 18 MARK. SO WE ARE OF THE OPINION THAT AS LONG AS 5910 IS NOT BROKEN ONE MUST UTILIZE EVERY DECLINE AS A BUYING OPPORTUNITY. HOWEVER ONE MUST BE VERY CHOOSY IN STOCK SELECTION.

Monday 15 July 2013

NIFTY UPDATES 15713

NIFTY TODAY FORMED A MARUBOZU CANDLE STICK PATTERN ON A DAILY CHART. AS PER OPTION CHAIN 6000 CE IS HAVING HIGHER OI THAN 6000 PE WHICH IS SOMETHING SURPRISING AS VIX TOO HAS CLOSED IN GREEN. SO A CAUTIOUS APPROACH IS REQUIRED FOR BULLS. BUT STILL WE ARE BULLISH ON THE INDEX WITH REVISED SL OF 5980. AS LONG AS 5980 IS IN TACT TRADERS MUST STICK TO BUY ON DECLINE STRATEGY.

Sunday 14 July 2013

NIFTY UPDATES 14713

AFTER MOVING IN A RANGE OF 5750-5900 NIFTY BROKE THE RANGE AND FINALLY CLOSED ABOVE 6000 LEVEL. AS PER OPTION CHAIN NIFTY HAS SUPPORT AT 5900 LEVEL AND IMMEDIATE RESISTANCE 6000 LEVEL. NIFTY WILL NOW BE TRADING IN MULTIPLE RESISTANCE ZONE. VIX CALMED DOWN FROM 20 LEVEL AND CLOSED AT 18.7 MARK. THE UNIQUE FEATURE OF THE RECENT RALLY IS THAT IT HAS NOT BEEN LED BY BANKING SECTOR. THE TREND OF THE MARKET IS UP WITH A VERY CHOOSY STOCKS. WE ARE BULLISH ON THE INDEX AS LONG AS 5940 IS NOT BREACHED ON CLOSING BASIS. ON UPPER SIDE IMMEDIATE RESISTANCE IS AROUND 6055 LEVEL.

AS OF NOW BULLS ARE HAVING UPPER HAND.

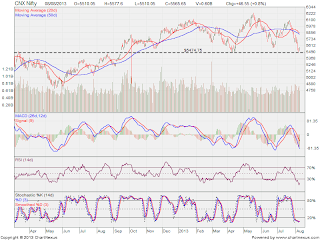

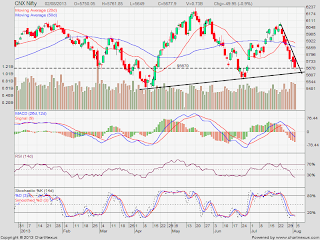

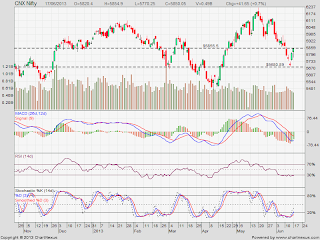

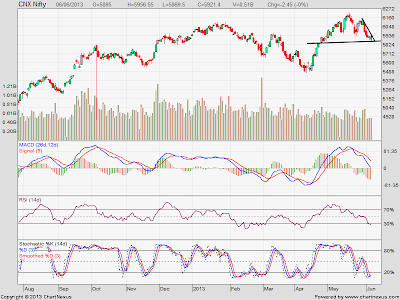

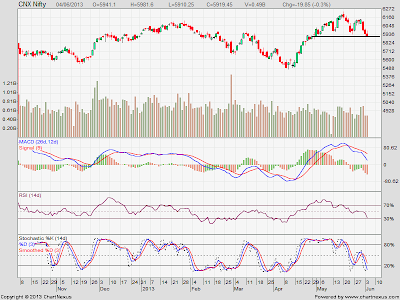

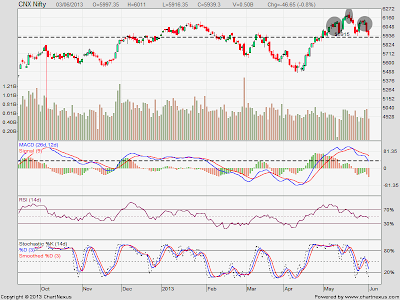

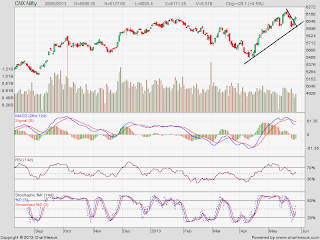

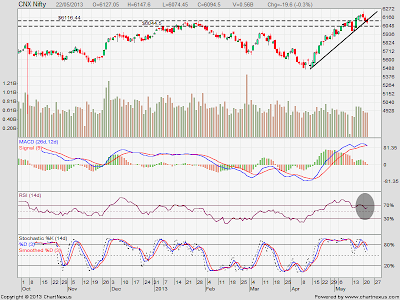

NIFTY DAILY CHART

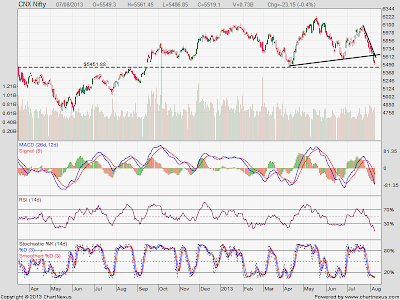

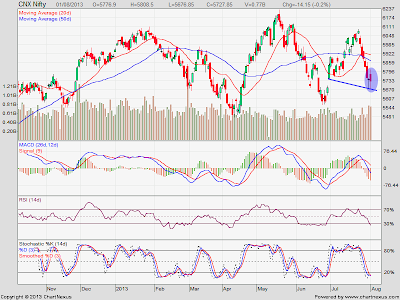

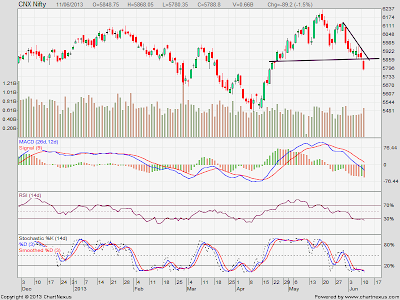

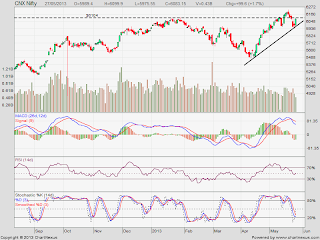

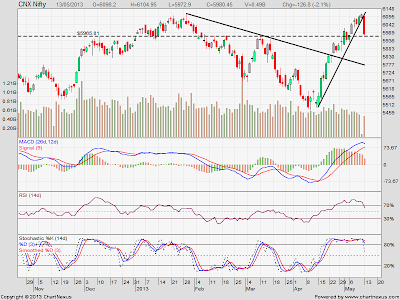

NIFTY DAILY CHART WITH FIBO TOOL

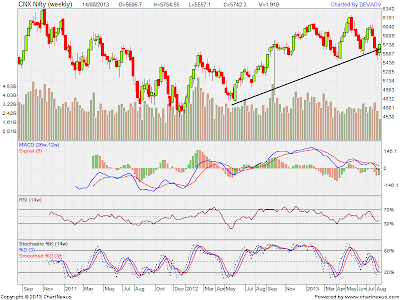

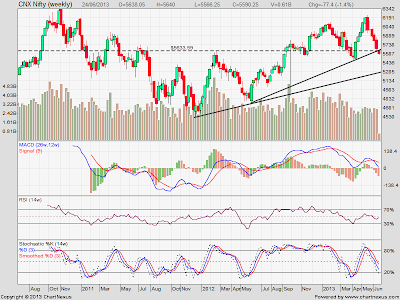

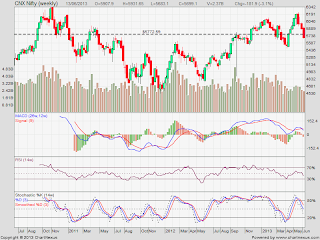

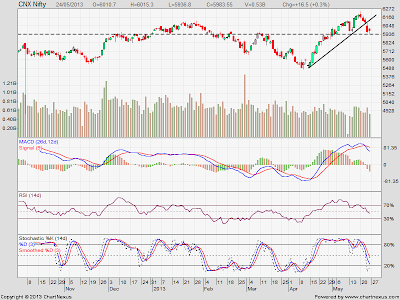

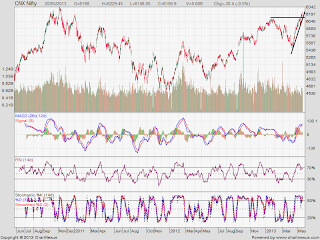

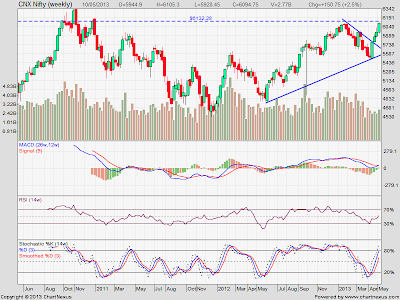

NIFTY WEEKLY CHART.

Wednesday 10 July 2013

NIFTY UPDATES 10713

NIFTY IS TRADING IN A RANGE OF 5750-5900 FOR THE LAST MANY DAYS. WITH VIX NEAR 20 MARK AND AS WE ARE APPROACHING WEEKLY CLOSE BREAK OF THE RANGE ON EITHER SIDE MAY LEAD DIRECTIONAL MOVE. HOWEVER AS OF NOW NIFTY IS LOOKING SLIGHTLY BULLISH AND WE ARE OF THE OPINION THAT TRADERS SHOULD ADOPT BUY ON DECLINE STRATEGY AS LONG AS 5750 IS IN TACT.

WITH MODERATE BULLISH VIEW ON THE INDEX WE RECOMMEND BULL SPREAD OPTION STRATEGY. TRADERS CAN BUY 5800 CE AT 100 AND SELL 5900 CE AT 53. PREMIUM PAID 47 SL 25 TGT 80-90

Sunday 7 July 2013

NIFTY UPDATES : 7713

NIFTY IS FINDING RESISTANCE AROUND 5900 MARK AND IS UNABLE TO CROSS 5910 LEVEL ON A CLOSING BASIS. HOWEVER IT IS SUCCESSFULLY HOLDING ABOVE 5830 LEVEL WHICH IS QUITE A POSITIVE SIGN. ON A WEEKLY BASIS NIFTY BREACHED 5600 LEVEL BUT MANAGED TO CLOSE ABOVE THE SAME DURING RECENT PAST. LAST WEEK IT FORMED A BULLISH ENGULFING PATTERN ON A WEEKLY CHART AND THIS WEEK TOO IT MANAGED TO GIVE CLOSE ABOVE 5830. SO THE SHORT TERM PICTURE FAVORS THE BULL AS LONG AS NIFTY IS HOLDING 5750 LEVEL. CONSECUTIVE DAILY CLOSE ABOVE 5910 PLUS WEEKLY CLOSE ABOVE 5977 MAY LEAD THE INDEX TO MOVE 6104 LEVEL.

SUPPORT 5815-5750

RESISTANCE 5910-5977

Monday 24 June 2013

NIFTY UPDATES 24613

NIFTY HAD A GOOD WEEKLY SUPPORT IN 5770 ZONE WHICH HAS BEEN BROKEN AND THE NEXT MAJOR WEEKLY SUPPORT NOW IS IN THE ZONE OF 5630 LEVELS. NIFTY HAS CLOSED AT 5990 WITH VIX ABOVE 21 LEVEL. AS NOW THE JUNE EXPIRY IS ABOUT TO HAPPEN MARKETS MAY WITNESS EXTREME VOLATILE MOVES AND TRADES MUST AVOID HIGH BETA STOCKS TO PREVENT THEMSELVES FROM ANY UNMANAGEABLE LOSS. LOOKING AT THE OPTION CHAIN EXPIRY RANGE MAY BE 5550-5650 BUT AS MENTIONED EARLIER VIX IS THE MAJOR CONCERN NOW.

Wednesday 19 June 2013

NIFTY DARLING 19613

NIFTY IS FINDING SUPPORT AROUND 5770 LEVELS AND WITNESSING BOUNCE BACK. TODAY IT KISSED 5777 LEVEL AND MOVED UP. AS PER OPTION CHAIN HUGE OPTION WAS BUILT UP AT 5600 PE AND 5700 PE OF 12.68 LAC AND 13 LAC. TOTAL OI AT 5700 PE IS 87.33 LAC. TOTAL OI AT 5800 PE IS 75.18 LAC AND 5800 CE IS 56.94. TOTAL OI AT 5900 CE IS 75.92 LAC. SO 5700 IS THE WALL OF SUPPORT FOR NIFTY WHEREAS 5900 REMAINS THE IMMEDIATE RESISTANCE. LOOKING AT THE CHART AND OPTION DATA WE EXPECT THAT CHANCES OF NIFTY KISSING 5900 LEVEL ARE VERY HIGH. HOWEVER THE ONLY CONCERN IS VIX WHICH HAS RISEN TODAY AND CLOSED AT 18.46 LEVEL.

Tuesday 18 June 2013

NIFTY UPDATES 18613

NIFTY CLOSED BELOW THE SUPPORT LEVEL IN THE ZONE 5815. 5700 PE IS STILL HAVING HIGHEST OI OF 74.23 LAC. OI AT 5800 LEVEL IS ALMOST EQUAL WHEREAS TOTAL OI AT 5900 MARK IS 74.64 LAC WITH HUGE ADDITION OF 15.14 LAC IN OI. RUPEE CLOSED AT THE LOWEST LEVEL. CONSIDERING THESE FACTORS IT SEEMS MARKETS STILL IN FIRM GRIP OF BEARS AND EVERY BOUNCE BACK IS NOW BEING USED TO INITIATE SHORTS.

SUPPORT AT 5770-5740

RESISTANCE 5920-5970.

Monday 17 June 2013

NIFTY UPDATES 17613

NIFTY FORMED A PIN BAR PATTERN ON A DAILY CHART TODAY. IT KISSED THE RESISTANCE ZONE OF 5855 AND MANAGED TO CLOSE ABOVE 5850. 5700 PE IS HAVING HIGHEST OI OF 82.74 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 52..55 LAC AND 71.59 LAC RESPECTIVELY. TOTAL OI AT 5900 CE IS 64.44 LAC. 6000 CE IS HAVING HIGHEST OI OF 80.59 LAC. VIX CLOSED AT 18.18 MARK DOWN BY ALMOST 1%. SO 5700 HAS EMERGED AS A VERY STRONG SUPPORT AND 5900 MARK REMAINS THE NEXT RESISTANCE.

BUY ABOVE 5860 SL 5820 TGT 5900-5920

SELL BELOW 5820 SL 5860 TGT 5790-5770

Thursday 13 June 2013

NIFTY UPDATES 13613

MARKETS ARE IN FIRM GRIP OF THE BEARS AND EVERY BOUNCE IN THE NIFTY IS PROVING SHORT LIVED. TOMORROW BEING WEEKLY CLOSE WITH VIX ABOVE 19 MARK MARKETS MAY MOVE ERRATICALLY. 5772 IS THE WEEKLY SUPPORT LEVEL FOR THE NIFTY FOR WHICH BULLS MAY FIGHT TOMORROW. AS PER OPTION CHAIN 5700 PE IS HAVING OI OF 71.28 LAC WHEREAS OI AT 5700 CE IS 35.65 LAC WITH ADDITION OF HUGE 20 LAC IN OI. TOTAL OI AT 5800 CE AND 5800 PE IS 56.5 LAC AND 52.4 LAC. OI AT 5900 CE IS 65.63 LAC. SO 5700 IS THE STRONG SUPPORT FOR THE BULLS. CONSIDERING ALMOST EQUAL OI AT 5800 MARK TOUGH FIGHT WILL BE SEEN FOR 5772 LEVELS AS MENTIONED EARLIER.

Wednesday 12 June 2013

NIFTY UPDATES 12613

NIFTY KISSED VERY CRUCIAL SUPPORT AROUND 5740 AND JUST MANAGED TO CLOSE ABOVE 5760 MARK. AFTER CONTINUOUS DECLINE IT FORMED A DOJI CANDLESTICK ON A DAILY CHART. AS PER OPTION CHAIN 5700 PE IS HAVING HIGHEST OI OF 73.12 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 53 LAC AND 63.6 LAC. LIQUIDATION WAS SEEN IN 5900 PE. TOTAL OI AT 5900 CE IS 57 LAC AND AT 6000 CE IS 75.5 LAC. VIX CLOSED AT 18.85 MARK AFTER KISSING ALMOST 20 LEVEL. RUPEE STRENGTHENED AFTER GOVERNMENT INTERVENTION AND INDIA'S RATING WAS UPGRADED TO STABLE FROM NEGATIVE. CONSIDERING ALL THESE FACTORS IT IS EVIDENT THAT MARKETS MAY CONSOLIDATE OR MOVE NORTHWARDS THOUGH THE OVERALL TREND IS STILL NEGATIVE WITH NO SIGN OF REVERSAL. GOING FORWARD TILL RBI MEET WE BELIEVE MARKETS MAY CONSOLIDATE IN RANGE OF 5750 TO 5900 WITH HIGHLY STOCK SPECIFIC MOVES. BUT AS VIX IS TRADING CLOSE TO 20 TRADERS ARE ADVISED TO EXERCISE EXTRA CAUTION AND AVOID OVER LEVERAGING.

Tuesday 11 June 2013

NIFTY UPDATES 11613

CONSIDERING THE OVERSOLD POSITION IN INDEX MAJORS AND THE FACT THAT NIFTY WAS HOLDING 5860 ON CLOSING BASIS WE EXPECTED A TECHNICAL BOUNCE BACK TODAY BUT NIFTY OPENED GAP DOWN AND TRADED WITH NEGATIVE BIAS THROUGH OUT THE DAY MAINLY DUE TO THE WEAKENING RUPEE. HEAVY LIQUIDATION SEEN IN 5900 PE AND HUGE OPEN INTEREST BUILT UP AT 5800 CE. SO AFTER LOSING 6000 LEVELS BULLS WERE UNABLE TO HOLD 5900 MARK. TOTAL OI AT 5800 PE IS 63.42 LAC AND OI AT 5700 PE IS 65.12 LAC. TOTAL OI AT 5900 CE IS 52.34 LAC. VIX ROSE BY 7.6% AND CLOSED ABOVE 19 MARK. SO MARKETS ARE EXPECTED TO BE HIGHLY VOLATILE AHEAD AND TRADERS ARE ADVISED TO AVOID OVER LEVERAGING POSITION OVERNIGHT.

SUPPORT 5740-5725

RESISTANCE 5815-5840

Monday 10 June 2013

NIFTY UPDATES 10613

ON THE BACK OF POSITIVE CUES FROM GLOBAL MARKETS NIFTY OPENED GAP UP BUT FAILED TO CAPITALIZE ON THE SAME. DURING LAST HOUR IT SLIPPED BELOW 5860 BUT RECOVERED QUICKLY AND CLOSED AT 5878. NIFTY IS CLOSING BELOW 5900 MARK FOR THE LAST 2 SESSIONS BUT STILL 5900 PE IS HAVING HIGHEST OPEN INTEREST OF 66.63 LAC WHICH IS QUITE SURPRISING. 5800 PE IS HAVING OI OF 64.3 LAC. TOTAL OI AT 6000 CE AND 6000 PE IS 60.68 LAC AND 35.24 LAC. SO BULLS HAVE GRADUALLY LOST GRIP ON 6000 MARK BUT STILL TRYING TO HOLD 5900 MARK. VIX ROSE BY 4.38% AND CLOSED ABOVE 18 MARK. HOWEVER WE THINK RISE IN VIX IS MORE ATTRIBUTABLE TO THE MAJOR EVENTS AHEAD IN THIS WEEK AND RBI POLICY ON 17TH JUNE. CONSIDERING THE CURRENT SCENARIO WE ARE OF THE OPINION THAT THOUGH THE MAJOR TREND IS DOWN TECHNICAL BOUNCE BACK FROM HERE CAN'T BE RULED OUT.

SUPPORT 5860-5840

RESISTANCE 5935-5980

Sunday 9 June 2013

NIFTY UPDATES 9613

AS EXPECTED MARKETS WITNESSED HIGH VOLATILITY DURING LAST SESSION DUE TO WEEKLY CLOSE. NIFTY OPENED GAP DOWN BUT SHOWED GRADUAL RECOVERY AND KISSED 5972 MARK WHERE IT FOUND RESISTANCE AND PERISHED AND CLOSED BELOW 5900 MARK. NIFTY IS MOVING ERRATICALLY WITHIN THE RANGE OF 5870-5980 FOR THE LAST MANY SESSIONS. NIFTY HAS CLOSED BELOW 5900 MARK BUT STILL 5900 PE IS HAVING HIGHEST OPEN INTEREST OF 67 LAC. OI AT 5900 CE IS 40.72 LAC. 6000 CE IS HAVING OI OF 58 LAC WITH HUGE ADDITION OF 11 LAC IN OI. VIX CLOSED FLAT. SO FROM THE OPEN CHAIN IT CAN BE DERIVED THAT GOING FORWARD MARKETS MAY MOVE IN A RANGE OF 5860-5980. THOUGH THE BIAS IS STILL NEGATIVE.

SUPPORT 5860-5840

RESISTANCE 5940-5980

Thursday 6 June 2013

NIFTY UPDATES 6613

NIFTY OPENED GAP DOWN ON WEAK GLOBAL CLUES BUT RECOVERED GRADUALLY AND FINALLY CLOSED AT 5921.4. NIFTY IS BREAKING 5900 LEVELS ON INTRADAY BASIS AND WITNESSING RECOVERY FROM THE LAST 2 SESSIONS. FOR THE LAST 3 SESSIONS IT IS CLOSING BELOW 5935 MARK INDICATING A CLEAR WEAKNESS. HOWEVER AS PER OPTION CHAIN 5900 PE IS STILL HAVING HIGHEST OI OF 69.5 LAC SO 5900 STILL REMAINS A VERY STRONG SUPPORT FOR NIFTY. VIX ROSE BY 3.4% AND CLOSED WELL ABOVE 17 MARK. TOMORROW BEING WEEKLY CLOSE MARKETS ARE EXPECTED TO BE HIGHLY VOLATILE.

Wednesday 5 June 2013

NIFTY UPDATES 6513

NIFTY AFTER A CONTINUOUS DECLINE TOOK PAUSE TODAY. IT LOST 5900 LEVEL DURING INTRADAY BUT SHOWED RECOVERY FROM 5883 LEVELS. STILL 5900 PE IS HAVING HIGHEST OPEN INTEREST OF 64 LAC SO 5900 IS ACTING AS STRONG SUPPORT FOR NIFTY. VIX FELL BY ALMOST 3% AND CLOSED BELOW 17 MARK. MARKET BREADTH TOO SLIGHTLY CLOSED ON ADVANCING SIDE. OPEN INTEREST AT 6000 CE AND 6000 PE IS 44 LAC AND 36 LAC RESPECTIVELY WITH HIGHEST OI AT 6200 MARK. CONSIDERING ALL THESE FACTORS IT SEEMS THAT MARKETS MAY CONSOLIDATE IN A RANGE OF 5900-6000 THOUGH THE OVERALL BIAS IN ON NEGATIVE SIDE. STOCK SPECIFIC MOVES WILL BE SEEN IN MARKETS

SUPPORT AND RESISTANCE LEVELS REMAIN THE SAME

Tuesday 4 June 2013

NIFTY UPDATES 4613

AS MENTIONED IN OUR PREVIOUS POST NIFTY WITNESSED BOUNCE BACK AND FOUND RESISTANCE AROUND 5980 AND KISSED THE NECKLINE AREA OF 5910 AGAIN TODAY. HOWEVER TODAY NIFTY NOT ONLY LOST ITS EARLIER GAIN BUT ALSO SLIPPED BELOW IT YESTERDAY'S LOW AND CLOSED BELOW 5935 MARK SUGGESTING A CLEAR NEGATIVE BIAS. HOWEVER AS PER OPTION CHAIN 5900 PE IS STILL HAVING HIGHEST OPEN INTEREST IMPLYING THAT 5900 IS STILL A STRONG SUPPORT AREA. 6000 CE IS HAVING OPEN INTEREST OF 46.78 LAC WITH ADDITION OF 4.22 LAC IN OI WHEREAS OI AT 6000 PE IS HAVING OI OF 38.10 LAC WITH LIQUIDATION OF 0.77 LAC. SO BULLS ARE LOSING GRIP ON 6000 MARK. OI AT 6100 CE AND 6200 CE IS 54 LAC EACH. SO 6100 REMAINS STIFF RESISTANCE. VIX IS STILL ABOVE 17 MARK.

SO BIAS IS NEGATIVE NOW AND BREACH OF 5900 MARK MAY INCREASE THE SELLING PRESSURE.

SUPPORT AT 5910-5860

RESISTANCE 5940-5980

Monday 3 June 2013

NIFTY UPDATES 3613

NIFTY TODAY OPENED FLAT AND TRADED WITH NEGATIVE BIAS IN EARLY TRADES AND KISSED A CRUCIAL SUPPORT AREA AT 5910 MARK. DURING LAST HOUR IT TRIED TO TRIM LOSSES BUT FAILED AND FINALLY MANAGED TO CLOSE AT 5939. IT IS CLEARLY VISIBLE THAT ON A DAILY CHART NIFTY IS FORMING H&S PATTERN AND FINDING GOOD SUPPORT AROUND IT NECKLINE AREA OF 5910. AS PER OPTION CHAIN STILL 5900 PE IS HAVING HIGHEST OI . LIQUIDATION IS SEEN IN 6000 PE AND OI WAS BUILT UP 6000 CE. THOUGH THE DIFFERENCE OF TOTAL OI AT 6000 CE AND 6000 PE IS NEGLIGIBLE. CONSIDERING THE OPTIONS DATA AND OVERSOLD POSITION IN CERTAIN INDEX MAJORS NIFTY MAY CONSOLIDATE IN A RANGE OF 5900-6000 OR WE MIGHT WITNESS TECHNICAL BOUNCE BACK FROM HERE.

SUPPORT 5910-5880

RESISTANCE 5980-6011

Sunday 2 June 2013

NIFTY UPDATES 2613

FOR THE LAST TWO MONTHS MARKETS ARE MOVING LIKE ANYTHING. IN APRIL NIFTY KISSED 5477 LEVEL AND RECOVERED SHARPLY AND POSTED HIGH OF 6229 IN THE MONTH OF MAY. ON THE EXPIRY DAY IT GAVE A VERY POWERFUL CLOSE AT 6124 AND ON THE NEXT SESSION IT GAVE A VERY SHARP CORRECTION OF 138 POINTS. ON A DAILY CHART NIFTY JUST MANAGED TO HOLD 5974 LEVEL ON A CLOSING BASIS. ON A WEEKLY CHART IT FORMED A DOJI PATTERN. AS PER OPTION CHAIN 6000 PE IS HAVING HIGHEST OPEN INTEREST OF 55.16 LAC. 5900 PE IS HAVING OI OF 51.45 LAC WITH ADDITION OF MORE THAN 10 LAC. HIGHEST OI BUILT UP AT 6100 CE OF 11.68 LAC. 6200 CE IS HAVING HIGHEST OI OF 42.58 LAC. VIX CLOSED AT 16.99.

Tuesday 28 May 2013

NIFTY UPDATES 28513

THOUGH THE NIFTY IS MOVING IN A RANGE VOLATILITY IS AT ITS BEST... :).. NIFTY TODAY MANAGED TO GIVE CLOSE ABOVE 6100 MARK AFTER KISSING 6127 LEVEL. HEAVY LIQUIDATION SEEN AT 6000 AND 6100 CE SUGGESTING FORCED SHORT COVERING. 6100 PE ADDED HIGHEST IN OPEN INTEREST, THOUGH TOTAL OI AT 6100 CE IS HIGHER THAN THAT OF 6100 PE. 6200 CE ADDED HIGHEST IN OI. VIX ROSE MARGINALLY AND STILL CLOSED ABOVE 17 MARK. NEEDLESS TO MENTION VOLATILE MOVES WILL STILL RULE AS MAY EXPIRY IS ABOUT TO HAPPEN IN COUPLE OF SESSIONS. RANGE NOW SEEMS TO BE 6080-6170

SUPPORT 6080-6044

RESISTANCE 6153-6172

Monday 27 May 2013

NIFTY UPDATES 27513

NIFTY TODAY RECOVERED SHARPLY AND GAVE A FIRM CLOSE NEAR 6100 MARK. THOUGH THE VOLUMES WERE QUITE LOWER TODAY THE MOVE WAS BACKED BY RALLY ACROSS THE SECTORS. AS PER THE OPTION CHAIN HUGE WRITING SEEN AT 6000 AND 6100 PE WHEREAS HEAVY SHORT COVERING SEEN AT 6000 CE. 6000 PE IS NOW HAVING HIGHEST OPEN INTEREST SO 6000 IS NOW GOING TO ACT AS STRONG SUPPORT AREA. ON THE OTHER HAND 6100 CE IS HAVING HIGHEST OPEN INTEREST SO IT IS NOW GOING TO ACT AS STIFF RESISTANCE. VIX WAS DOWN BY 3% AND CLOSED ABOVE 17.

IMMEDIATE RANGE AS PER THE DATA 6000-6100.

SUPPORT AT 6072-6044

RESISTANCE 6114-6168

ABOVE 6114 DON'T REMAIN SHORT........

Sunday 26 May 2013

NIFTY UPDATES 26513

NIFTY KISSED AN IMPORTANT SUPPORT ZONE OF 5930 AND RECOVERED SHARPLY. AS PER OPTION CHAIN TOO 5900 IS STILL A VERY STRONG SUPPORT AREA FOR NIFTY. OI AT 6000 CE IS MARGINALLY HIGHER THAN THE OI AT 6000 PE. SO THE FIGHT FOR CAPTURING 6000 WILL BE SEEN IN SESSIONS AHEAD. 6100 MARK IS REMAINS KEY RESISTANCE NOW. VIX FELL SHARPLY BUT STILL VERY CLOSE TO 18 MARK. SO AS WE ARE NOW ENTERING EXPIRY WEEK VOLATILE MOVES WILL BE SEEN IN MARKETS.

SUPPORT 5960-5930

RESISTANCE 6016-6044

Thursday 23 May 2013

NIFTY UPDATES 23513

NIFTY WITNESSED GAP DOWN OPENING AND INTENSE SELLING PRESSURE WAS SEEN IN MARKETS TODAY DUE TO GLOBAL NEWS PLUS POOR SBIN NUMBERS. WE WERE BULLISH ON THE MARKETS UNTIL 5974 WAS IN TACT ON CLOSING BASIS HOWEVER THE SAME LEVEL HAS NOW BEEN BROKEN ON CLOSING BASIS. OPTION CHAIN SUGGESTS BEARS TOOK COMPLETE CONTROL OF 6100 MARK. BULLS WERE FORCED TO COVER THEIR SHORTS AT 6000 AND 6100 CE. 5900 PE IS STILL HAVING HIGHEST OI SUGGESTING NEXT MAJOR SUPPORT FOR NIFTY. VIX CLOSED ABOVE 18. SO AS WE ARE APPROACHING NEAR MAY EXPIRY WITH VIX ABOVE 18 MARKETS MAY SHOW WILD VOLATILE MOVES IN SESSIONS AHEAD.

SUPPORT 5930-5880

RESISTANCE 5992-6016

Wednesday 22 May 2013

NIFTY UPDATES 22513

NIFTY TODAY OPENED GAP UP BUT AGAIN FAILED TO SUSTAIN AT HIGHER LEVELS AND WITNESSED SELLING PRESSURE DURING LAST HOUR. AS PER THE OPTION CHAIN 6000 STILL REMAINS A STRONG SUPPORT WHILE 6200 IS THE STIFF RESISTANCE ON THE UPPER SIDE. OPEN INTEREST AT 6100 CE AND PE IS ALMOST EQUAL. VIX ABOVE 17 AND NOW TRYING BREAK 18 MARK. SO MARKETS ARE EXPECTED TO MOVE IN A RANGE OF 6050-6150 WITH VOLATILE MOVES AS PER THE OPTION CHAIN DATA.

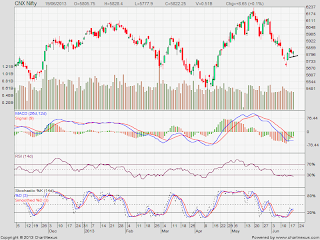

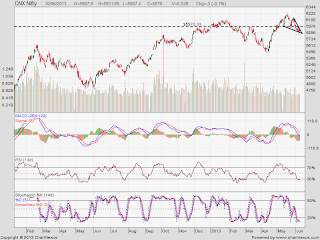

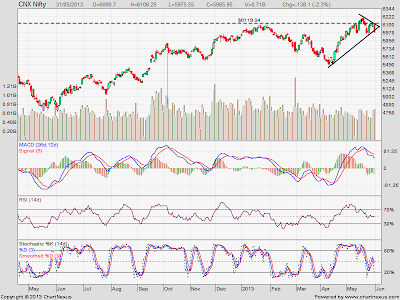

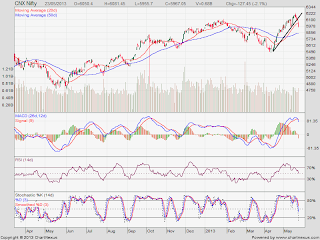

NIFTY DAILY CHART SHOWS POSITIVE DIVERGENCE OF RSI WHICH IS A BULLISH SIGN.

SUPPORT AT 6070-6044

RESISTANCE 6114-6148

DON' T REMAIN SHORT ABOVE 6172

Monday 20 May 2013

NIFTY UPDATES 2052013

NIFTY WITNESSED GAP UP OPENING TODAY BUT COULD NOT SUSTAIN AT HIGHER LEVELS AND WITNESSED PROFIT BOOKING. THE TREND STILL REMAINS BULLISH AND MARKETS MAY CONSOLIDATE IN COMING SESSIONS WITH STOCK SPECIFIC MOVES. NOW TODAY PROFIT BOOKING SEEN AT 5800 PE WHICH LIQUIDATED 13.85 LAC. HUGE OI BUILT UP AT 6200 PE OF 10.28 LAC SUGGESTING BULLS USED EVERY DECLINE TO MAKE BASE STRONGER AND STRONGER. TOTAL OI AT 6000 CE IS 85.88 LAC WITH ADDITION OF 6.72 LAC WHILE 6000 PE IS HAVING OI OF 29.13 LAC WITH LIQUIDATION OF 5 LAC. TOTAL OI AT 6100 SPOT IS ALMOST EQUAL. SO IT IS EVIDENT FROM THE OPTION CHAIN THAT TODAY'S FALL IS PURELY ATTRIBUTED TO PROFIT BOOKING.

NIFTY STRONG SUPPORT AT 6114

RESISTANCE 6170-6195

Wednesday 15 May 2013

NIFTY UPDATES 15513

NIFTY WITNESSED GAP UP OPENING TODAY AND TRADED WITH POSITIVE BIAS THROUGH OUT THE DAY AND FORMED A STRONG BULLISH CANDLE ON A DAILY CHART. HUGE LIQUIDATION SEEN TODAY AT 6000 CE OF 21.65 LAC. 6000 PE IS HAVING OI OF 73.32 LAC WITH ADDITION OF 13.5 LAC. TOTAL OI AT 6100 CE AND 6100 PE IS 61.3 LAC AND 47.63 LAC. TOTAL OI AT 6200 CE IS 68.7 LAC WITH LIQUIDATION OF 4.17 LAC. TOTAL OI AT 6200 PE IS 28.12 LAC WITH HUGE ADDITION OF 19.82 LAC. STILL 5800 PE IS HAVING HIGHEST OI OF 87.78 LAC. 5700 PE WITNESSED LIQUIDATION OF 13.46 LAC. VIX ROSE BY MORE THAN 5.5% AND CLOSED ABOVE 18. SO BEARS ARE STILL CHALLENGING THE 6100 LEVEL WHILE BULLS ARE TRYING HARD TO CAPTURE 6200 LEVEL.

VIX IS RISING WITH THE RISE IN MARKETS A PHENOMENON GENERALLY SEEN WHEN MARKETS ARE ABOUT TO CHALLENGE PRIOR TOP.

Tuesday 14 May 2013

NIFTY UPDATES 14513

NIFTY FORMED A DOJI AFTER A SHARP SELL OFF AND WE INDICATED YESTERDAY AS ALMOST EQUAL OI WAS BUILT UP AT 6000 CE AND 6000 PE. NIFTY OPENED IN A GREEN AND TRADED IN A RANGE OF 5970-6030, THOUGH THE MOVES WERE HIGHLY VOLATILE. EVEN TODAY 6000 CE AND 6000 PE IS HAVING ALMOST EQUAL OI. TOTAL OI AT 6100 CE AND 6200 CE IS 59.53 LAC AND 77.13 LAC RESPECTIVELY. 5900 PE IS HAVING OI OF 78.23 LAC WITH ADDITION OF 12.3 LAC IN OI. TOTAL OI AT 5700 AND 5800 PE IS 85.26 LAC AND 91.2 LAC RESPECTIVELY. VIX IS STILL ABOVE 17. SO OPTION CHAIN SUGGEST THAT 5800 HAS NOW EMERGED AS A VERY STRONG SUPPORT AND ON THE UPPER SIDE 6200 IS THE VERY STIFF RESISTANCE. TREND IS STILL UP AND MKTS ARE EXPECTED TO TRADE WITH POSITIVE BIAS, THOUGH VOLATILE MOVES MAY BE THERE IN MKTS..

SUPPORT 5970-5930

RESISTANCE 6027-6045

Monday 13 May 2013

NIFTY UPDATES 13513

AFTER A SHARP RALLY DURING RECENT PAST NIFTY WITNESSED MAJOR CORRECTION TODAY AND WAS DOWN BY MORE THAN 2%. WE WERE QUITE BULLISH ON THE MARKETS BUT SUDDENLY THE DYNAMICS CHANGED. NOW ALMOST EQUAL OI IS BUILT UP AT 6000 PE AND 6000 CE. 5900 PE IS HAVING OI OF 66.6 LAC WITH LIQUIDATION OF 5.46 LAC. OI AT 5700 AND 5800 PE IS 89.47 LAC AND 86.5 LAC. HIGHEST OI BUILT AT 6000 CE OF 14.44 LAC. 5900 CE IS HAVING OI OF 30.87 LAC. VIX ROSE BY 4% AND CLOSED ABOVE 17 MARK. SO BEARS GAVE A BIG PUNCH TODAY AND TIGHTENED THEIR GRIP AT 6000 MARK. 5800 IS STILL A STRONG SUPPORT.

WE EXPECT A CONSOLIDATION MAY HAPPEN IN A RANGE OF 5850-6050 BEFORE ANY DIRECTIONAL MOVE.

SUPPORT 5960-5930

RESISTANCE 6025-6045

Sunday 12 May 2013

NIFTY UPDATES 12513

DURING RECENT PAST MARKETS HAVE MOVED BEYOND ANYONE'S IMAGINATION. AT TIMES WE KEPT UPDATING NOT TO SHORT AND KEPT REMINDING THAT MARKETS ARE IN A UPTREND AND IT IS PRUDENT NOT TO CHALLENGE THE TREND. EVERYONE IS LOOKING FOR THE CORRECTION BUT THIS TIME MARKETS SEEM TO BE IN A DIFFERENT MOOD. GRADUALLY NIFTY KISSED 6100 MARK AND NOW A WEEKLY CHART SHOWS A SYMMETRICAL TRIANGLE SORT OF PATTERN. OPTION CHAIN SUGGEST 5900 MARK IS THE VERY STRONG SUPPORT AND 6000 MARK TOO HAS ALSO BEEN IN VERY FIRM GRIP OF BULLS NOW. VIX IS STILL STRUGGLING TO CROSS 17 MARK ON A CLOSING BASIS. NO RESISTANCE IS HINDERING THE NIFTY AND WE SENSE THE BULLS MAY CHANGE THE GEAR IN COMING SESSIONS. OUR REQUEST TO ALL THE TRADERS NOT TO SHORT ANYTHING IN MARKETS. KEEP LOOKING FOR STRONG COUNTERS AND HOLD THEM TIGHT TO RIDE THE WAVES.

Wednesday 8 May 2013

NIFTY UPDATES 8513

NIFTY FORMED A DOJI CANDLE STICK PATTERN ON A DAILY CHART TODAY AFTER A SHARP UP MOVE AND NOW TRYING TO KISS 52 WEEKS HIGH. THE OPTION CHAIN SUGGEST AFTER CAPTURING 5800, BULLS HAVE SUCCEEDED TO HAVE FIRM GRIP ON 5900 MARK TOO. 6100 STILL REMAINS A CRUCIAL RESISTANCE MARK. VIX ROSE BY MORE THAN 1.5% AND CLOSED AT 16.76 AFTER KISSING 17.22 LEVELS. THOUGH THERE IS NO SIGN OF ANY CORRECTION ONE MUST EXERCISE EXTRA CAUTION AT HIGHER LEVELS NOW FOR THE FOLLOWING THREE REASONS.

1. NIFTY IS NEAR 52 WEEK HIGH WHICH MAY LEAD PROFIT BOOKING

2. VIX IS RISING SO MARKETS MAY TURN HIGHLY VOLATILE

3. DOJI CANDLE STICK FORMATION AFTER SHARP UP MOVE.

Subscribe to:

Posts (Atom)