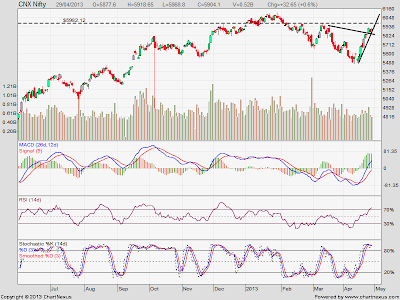

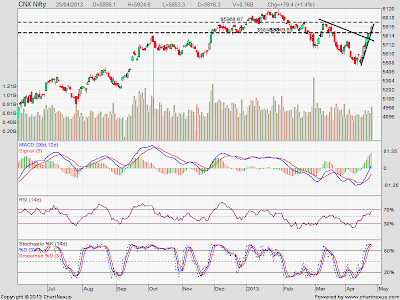

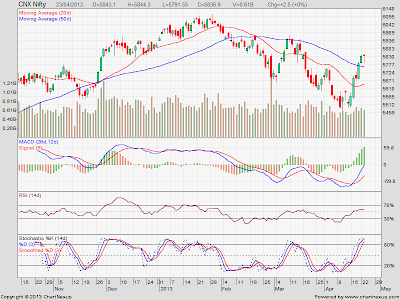

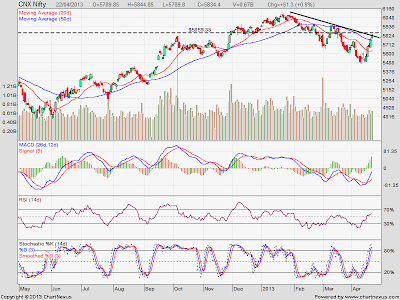

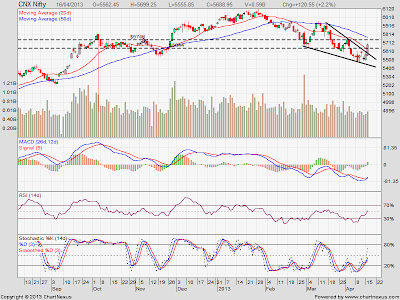

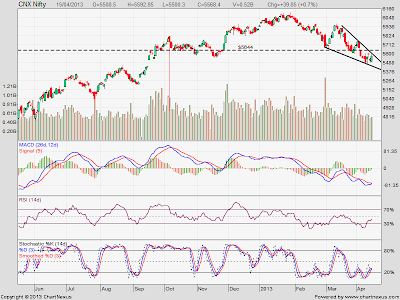

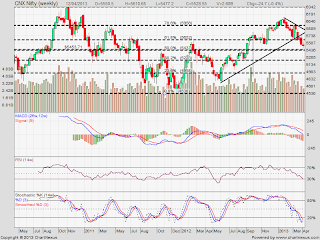

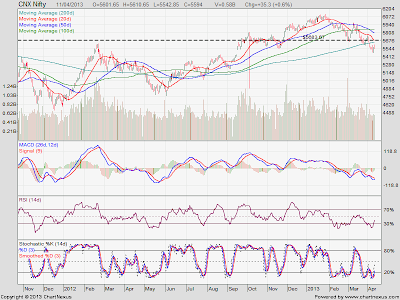

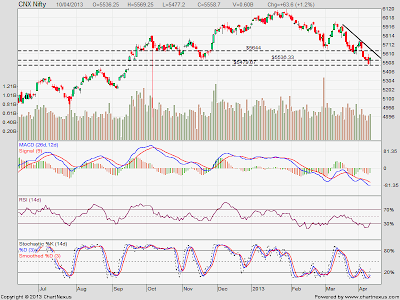

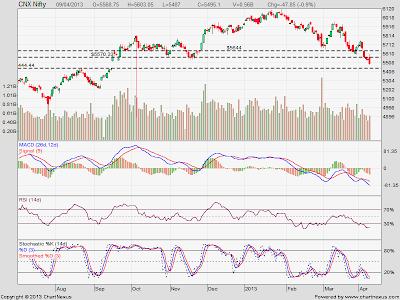

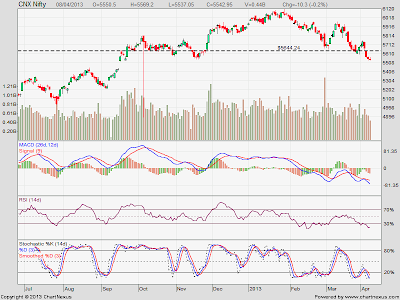

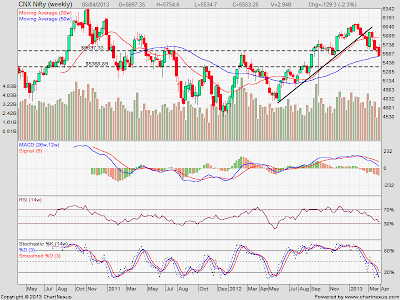

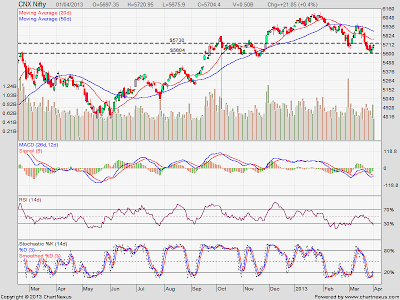

NIFTY TODAY MANAGED TO GIVE CLOSE ABOVE 5900 MARK. FOR THE LAST 3 SESSIONS NIFTY IS TRADING IN A RANGE OF 5850-5925. NOW 5900 PE IS HAVING OI OF 38.7 LAC AND 5900 CE IS HAVING OI OF 35.2 LAC. 5800 PE IS HAVING OI OF MORE THAN 50 LAC WHEREAS OI AT 6000 CE IS 41.78 LAC. VIX ROSE MORE THAN 3% AND FINALLY MANAGED TO CLOSE AT 14.33. SO NOT MUCH CAN BE DERIVED FROM THE OPTIONS CHAIN AS OF NOW. HOWEVER A TOUGH FIGHT IS EXPECTED BETWEEN BEARS AND BULLS FOR 5900 MARK. HOWEVER WE EXPECT THE BROADER MARKETS TO BE VOLATILE WITH HIGHLY STOCK SPECIFIC MOVES DUE TO RESULTS SEASON. THE BIAS IS STILL BULLISH.

SUPPORT 5860-5830

RESISTANCE 5930-5973