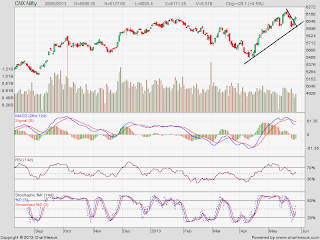

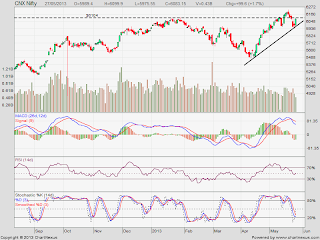

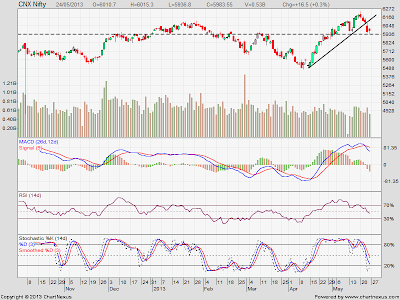

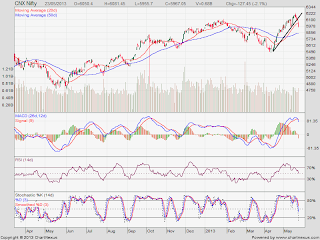

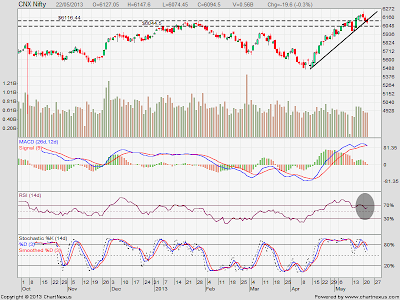

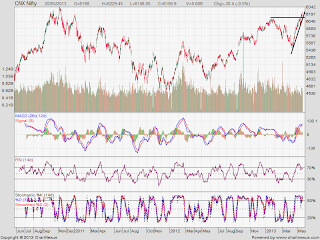

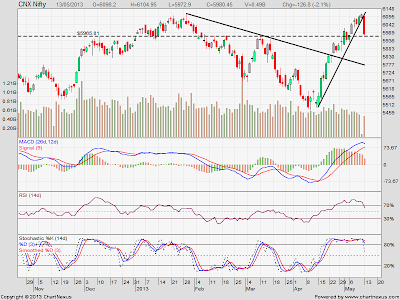

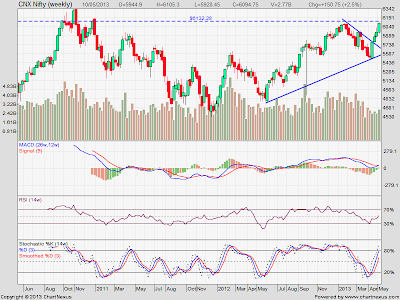

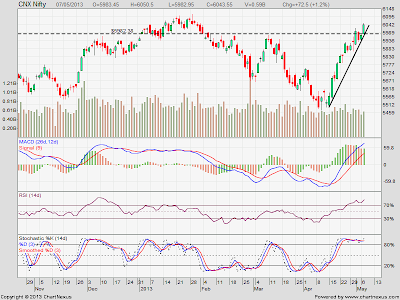

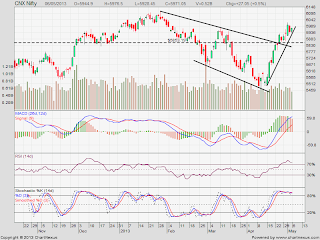

THOUGH THE NIFTY IS MOVING IN A RANGE VOLATILITY IS AT ITS BEST... :).. NIFTY TODAY MANAGED TO GIVE CLOSE ABOVE 6100 MARK AFTER KISSING 6127 LEVEL. HEAVY LIQUIDATION SEEN AT 6000 AND 6100 CE SUGGESTING FORCED SHORT COVERING. 6100 PE ADDED HIGHEST IN OPEN INTEREST, THOUGH TOTAL OI AT 6100 CE IS HIGHER THAN THAT OF 6100 PE. 6200 CE ADDED HIGHEST IN OI. VIX ROSE MARGINALLY AND STILL CLOSED ABOVE 17 MARK. NEEDLESS TO MENTION VOLATILE MOVES WILL STILL RULE AS MAY EXPIRY IS ABOUT TO HAPPEN IN COUPLE OF SESSIONS. RANGE NOW SEEMS TO BE 6080-6170

SUPPORT 6080-6044

RESISTANCE 6153-6172