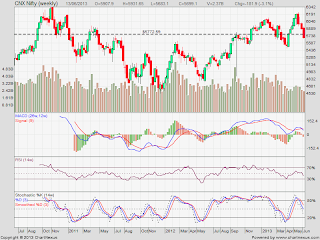

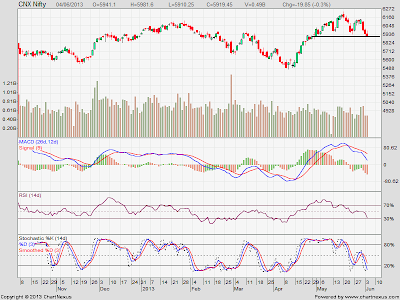

NIFTY HAD A GOOD WEEKLY SUPPORT IN 5770 ZONE WHICH HAS BEEN BROKEN AND THE NEXT MAJOR WEEKLY SUPPORT NOW IS IN THE ZONE OF 5630 LEVELS. NIFTY HAS CLOSED AT 5990 WITH VIX ABOVE 21 LEVEL. AS NOW THE JUNE EXPIRY IS ABOUT TO HAPPEN MARKETS MAY WITNESS EXTREME VOLATILE MOVES AND TRADES MUST AVOID HIGH BETA STOCKS TO PREVENT THEMSELVES FROM ANY UNMANAGEABLE LOSS. LOOKING AT THE OPTION CHAIN EXPIRY RANGE MAY BE 5550-5650 BUT AS MENTIONED EARLIER VIX IS THE MAJOR CONCERN NOW.

About Me

- DEV ADVISORY SERVICES

- NISM Certified Research Analyst & Mutual Fund Distributor.

Monday 24 June 2013

Wednesday 19 June 2013

NIFTY DARLING 19613

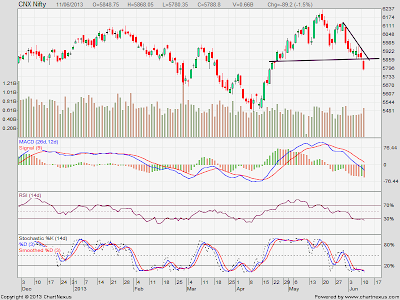

NIFTY IS FINDING SUPPORT AROUND 5770 LEVELS AND WITNESSING BOUNCE BACK. TODAY IT KISSED 5777 LEVEL AND MOVED UP. AS PER OPTION CHAIN HUGE OPTION WAS BUILT UP AT 5600 PE AND 5700 PE OF 12.68 LAC AND 13 LAC. TOTAL OI AT 5700 PE IS 87.33 LAC. TOTAL OI AT 5800 PE IS 75.18 LAC AND 5800 CE IS 56.94. TOTAL OI AT 5900 CE IS 75.92 LAC. SO 5700 IS THE WALL OF SUPPORT FOR NIFTY WHEREAS 5900 REMAINS THE IMMEDIATE RESISTANCE. LOOKING AT THE CHART AND OPTION DATA WE EXPECT THAT CHANCES OF NIFTY KISSING 5900 LEVEL ARE VERY HIGH. HOWEVER THE ONLY CONCERN IS VIX WHICH HAS RISEN TODAY AND CLOSED AT 18.46 LEVEL.

Tuesday 18 June 2013

NIFTY UPDATES 18613

NIFTY CLOSED BELOW THE SUPPORT LEVEL IN THE ZONE 5815. 5700 PE IS STILL HAVING HIGHEST OI OF 74.23 LAC. OI AT 5800 LEVEL IS ALMOST EQUAL WHEREAS TOTAL OI AT 5900 MARK IS 74.64 LAC WITH HUGE ADDITION OF 15.14 LAC IN OI. RUPEE CLOSED AT THE LOWEST LEVEL. CONSIDERING THESE FACTORS IT SEEMS MARKETS STILL IN FIRM GRIP OF BEARS AND EVERY BOUNCE BACK IS NOW BEING USED TO INITIATE SHORTS.

SUPPORT AT 5770-5740

RESISTANCE 5920-5970.

Monday 17 June 2013

NIFTY UPDATES 17613

NIFTY FORMED A PIN BAR PATTERN ON A DAILY CHART TODAY. IT KISSED THE RESISTANCE ZONE OF 5855 AND MANAGED TO CLOSE ABOVE 5850. 5700 PE IS HAVING HIGHEST OI OF 82.74 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 52..55 LAC AND 71.59 LAC RESPECTIVELY. TOTAL OI AT 5900 CE IS 64.44 LAC. 6000 CE IS HAVING HIGHEST OI OF 80.59 LAC. VIX CLOSED AT 18.18 MARK DOWN BY ALMOST 1%. SO 5700 HAS EMERGED AS A VERY STRONG SUPPORT AND 5900 MARK REMAINS THE NEXT RESISTANCE.

BUY ABOVE 5860 SL 5820 TGT 5900-5920

SELL BELOW 5820 SL 5860 TGT 5790-5770

Thursday 13 June 2013

NIFTY UPDATES 13613

MARKETS ARE IN FIRM GRIP OF THE BEARS AND EVERY BOUNCE IN THE NIFTY IS PROVING SHORT LIVED. TOMORROW BEING WEEKLY CLOSE WITH VIX ABOVE 19 MARK MARKETS MAY MOVE ERRATICALLY. 5772 IS THE WEEKLY SUPPORT LEVEL FOR THE NIFTY FOR WHICH BULLS MAY FIGHT TOMORROW. AS PER OPTION CHAIN 5700 PE IS HAVING OI OF 71.28 LAC WHEREAS OI AT 5700 CE IS 35.65 LAC WITH ADDITION OF HUGE 20 LAC IN OI. TOTAL OI AT 5800 CE AND 5800 PE IS 56.5 LAC AND 52.4 LAC. OI AT 5900 CE IS 65.63 LAC. SO 5700 IS THE STRONG SUPPORT FOR THE BULLS. CONSIDERING ALMOST EQUAL OI AT 5800 MARK TOUGH FIGHT WILL BE SEEN FOR 5772 LEVELS AS MENTIONED EARLIER.

Wednesday 12 June 2013

NIFTY UPDATES 12613

NIFTY KISSED VERY CRUCIAL SUPPORT AROUND 5740 AND JUST MANAGED TO CLOSE ABOVE 5760 MARK. AFTER CONTINUOUS DECLINE IT FORMED A DOJI CANDLESTICK ON A DAILY CHART. AS PER OPTION CHAIN 5700 PE IS HAVING HIGHEST OI OF 73.12 LAC. TOTAL OI AT 5800 CE AND 5800 PE IS 53 LAC AND 63.6 LAC. LIQUIDATION WAS SEEN IN 5900 PE. TOTAL OI AT 5900 CE IS 57 LAC AND AT 6000 CE IS 75.5 LAC. VIX CLOSED AT 18.85 MARK AFTER KISSING ALMOST 20 LEVEL. RUPEE STRENGTHENED AFTER GOVERNMENT INTERVENTION AND INDIA'S RATING WAS UPGRADED TO STABLE FROM NEGATIVE. CONSIDERING ALL THESE FACTORS IT IS EVIDENT THAT MARKETS MAY CONSOLIDATE OR MOVE NORTHWARDS THOUGH THE OVERALL TREND IS STILL NEGATIVE WITH NO SIGN OF REVERSAL. GOING FORWARD TILL RBI MEET WE BELIEVE MARKETS MAY CONSOLIDATE IN RANGE OF 5750 TO 5900 WITH HIGHLY STOCK SPECIFIC MOVES. BUT AS VIX IS TRADING CLOSE TO 20 TRADERS ARE ADVISED TO EXERCISE EXTRA CAUTION AND AVOID OVER LEVERAGING.

Tuesday 11 June 2013

NIFTY UPDATES 11613

CONSIDERING THE OVERSOLD POSITION IN INDEX MAJORS AND THE FACT THAT NIFTY WAS HOLDING 5860 ON CLOSING BASIS WE EXPECTED A TECHNICAL BOUNCE BACK TODAY BUT NIFTY OPENED GAP DOWN AND TRADED WITH NEGATIVE BIAS THROUGH OUT THE DAY MAINLY DUE TO THE WEAKENING RUPEE. HEAVY LIQUIDATION SEEN IN 5900 PE AND HUGE OPEN INTEREST BUILT UP AT 5800 CE. SO AFTER LOSING 6000 LEVELS BULLS WERE UNABLE TO HOLD 5900 MARK. TOTAL OI AT 5800 PE IS 63.42 LAC AND OI AT 5700 PE IS 65.12 LAC. TOTAL OI AT 5900 CE IS 52.34 LAC. VIX ROSE BY 7.6% AND CLOSED ABOVE 19 MARK. SO MARKETS ARE EXPECTED TO BE HIGHLY VOLATILE AHEAD AND TRADERS ARE ADVISED TO AVOID OVER LEVERAGING POSITION OVERNIGHT.

SUPPORT 5740-5725

RESISTANCE 5815-5840

Monday 10 June 2013

NIFTY UPDATES 10613

ON THE BACK OF POSITIVE CUES FROM GLOBAL MARKETS NIFTY OPENED GAP UP BUT FAILED TO CAPITALIZE ON THE SAME. DURING LAST HOUR IT SLIPPED BELOW 5860 BUT RECOVERED QUICKLY AND CLOSED AT 5878. NIFTY IS CLOSING BELOW 5900 MARK FOR THE LAST 2 SESSIONS BUT STILL 5900 PE IS HAVING HIGHEST OPEN INTEREST OF 66.63 LAC WHICH IS QUITE SURPRISING. 5800 PE IS HAVING OI OF 64.3 LAC. TOTAL OI AT 6000 CE AND 6000 PE IS 60.68 LAC AND 35.24 LAC. SO BULLS HAVE GRADUALLY LOST GRIP ON 6000 MARK BUT STILL TRYING TO HOLD 5900 MARK. VIX ROSE BY 4.38% AND CLOSED ABOVE 18 MARK. HOWEVER WE THINK RISE IN VIX IS MORE ATTRIBUTABLE TO THE MAJOR EVENTS AHEAD IN THIS WEEK AND RBI POLICY ON 17TH JUNE. CONSIDERING THE CURRENT SCENARIO WE ARE OF THE OPINION THAT THOUGH THE MAJOR TREND IS DOWN TECHNICAL BOUNCE BACK FROM HERE CAN'T BE RULED OUT.

SUPPORT 5860-5840

RESISTANCE 5935-5980

Sunday 9 June 2013

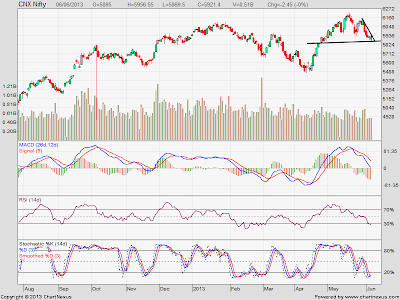

NIFTY UPDATES 9613

AS EXPECTED MARKETS WITNESSED HIGH VOLATILITY DURING LAST SESSION DUE TO WEEKLY CLOSE. NIFTY OPENED GAP DOWN BUT SHOWED GRADUAL RECOVERY AND KISSED 5972 MARK WHERE IT FOUND RESISTANCE AND PERISHED AND CLOSED BELOW 5900 MARK. NIFTY IS MOVING ERRATICALLY WITHIN THE RANGE OF 5870-5980 FOR THE LAST MANY SESSIONS. NIFTY HAS CLOSED BELOW 5900 MARK BUT STILL 5900 PE IS HAVING HIGHEST OPEN INTEREST OF 67 LAC. OI AT 5900 CE IS 40.72 LAC. 6000 CE IS HAVING OI OF 58 LAC WITH HUGE ADDITION OF 11 LAC IN OI. VIX CLOSED FLAT. SO FROM THE OPEN CHAIN IT CAN BE DERIVED THAT GOING FORWARD MARKETS MAY MOVE IN A RANGE OF 5860-5980. THOUGH THE BIAS IS STILL NEGATIVE.

SUPPORT 5860-5840

RESISTANCE 5940-5980

Thursday 6 June 2013

NIFTY UPDATES 6613

NIFTY OPENED GAP DOWN ON WEAK GLOBAL CLUES BUT RECOVERED GRADUALLY AND FINALLY CLOSED AT 5921.4. NIFTY IS BREAKING 5900 LEVELS ON INTRADAY BASIS AND WITNESSING RECOVERY FROM THE LAST 2 SESSIONS. FOR THE LAST 3 SESSIONS IT IS CLOSING BELOW 5935 MARK INDICATING A CLEAR WEAKNESS. HOWEVER AS PER OPTION CHAIN 5900 PE IS STILL HAVING HIGHEST OI OF 69.5 LAC SO 5900 STILL REMAINS A VERY STRONG SUPPORT FOR NIFTY. VIX ROSE BY 3.4% AND CLOSED WELL ABOVE 17 MARK. TOMORROW BEING WEEKLY CLOSE MARKETS ARE EXPECTED TO BE HIGHLY VOLATILE.

Wednesday 5 June 2013

NIFTY UPDATES 6513

NIFTY AFTER A CONTINUOUS DECLINE TOOK PAUSE TODAY. IT LOST 5900 LEVEL DURING INTRADAY BUT SHOWED RECOVERY FROM 5883 LEVELS. STILL 5900 PE IS HAVING HIGHEST OPEN INTEREST OF 64 LAC SO 5900 IS ACTING AS STRONG SUPPORT FOR NIFTY. VIX FELL BY ALMOST 3% AND CLOSED BELOW 17 MARK. MARKET BREADTH TOO SLIGHTLY CLOSED ON ADVANCING SIDE. OPEN INTEREST AT 6000 CE AND 6000 PE IS 44 LAC AND 36 LAC RESPECTIVELY WITH HIGHEST OI AT 6200 MARK. CONSIDERING ALL THESE FACTORS IT SEEMS THAT MARKETS MAY CONSOLIDATE IN A RANGE OF 5900-6000 THOUGH THE OVERALL BIAS IN ON NEGATIVE SIDE. STOCK SPECIFIC MOVES WILL BE SEEN IN MARKETS

SUPPORT AND RESISTANCE LEVELS REMAIN THE SAME

Tuesday 4 June 2013

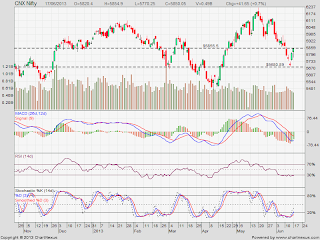

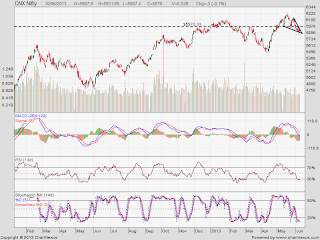

NIFTY UPDATES 4613

AS MENTIONED IN OUR PREVIOUS POST NIFTY WITNESSED BOUNCE BACK AND FOUND RESISTANCE AROUND 5980 AND KISSED THE NECKLINE AREA OF 5910 AGAIN TODAY. HOWEVER TODAY NIFTY NOT ONLY LOST ITS EARLIER GAIN BUT ALSO SLIPPED BELOW IT YESTERDAY'S LOW AND CLOSED BELOW 5935 MARK SUGGESTING A CLEAR NEGATIVE BIAS. HOWEVER AS PER OPTION CHAIN 5900 PE IS STILL HAVING HIGHEST OPEN INTEREST IMPLYING THAT 5900 IS STILL A STRONG SUPPORT AREA. 6000 CE IS HAVING OPEN INTEREST OF 46.78 LAC WITH ADDITION OF 4.22 LAC IN OI WHEREAS OI AT 6000 PE IS HAVING OI OF 38.10 LAC WITH LIQUIDATION OF 0.77 LAC. SO BULLS ARE LOSING GRIP ON 6000 MARK. OI AT 6100 CE AND 6200 CE IS 54 LAC EACH. SO 6100 REMAINS STIFF RESISTANCE. VIX IS STILL ABOVE 17 MARK.

SO BIAS IS NEGATIVE NOW AND BREACH OF 5900 MARK MAY INCREASE THE SELLING PRESSURE.

SUPPORT AT 5910-5860

RESISTANCE 5940-5980

Monday 3 June 2013

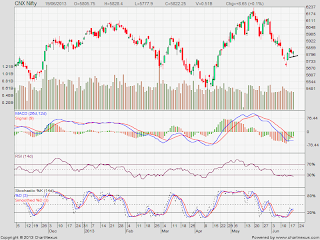

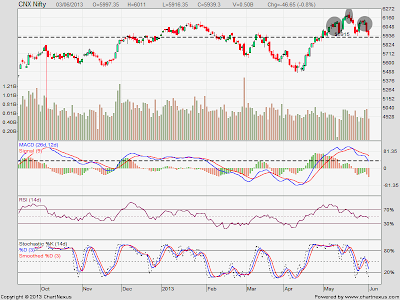

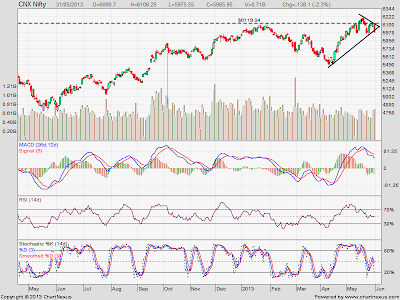

NIFTY UPDATES 3613

NIFTY TODAY OPENED FLAT AND TRADED WITH NEGATIVE BIAS IN EARLY TRADES AND KISSED A CRUCIAL SUPPORT AREA AT 5910 MARK. DURING LAST HOUR IT TRIED TO TRIM LOSSES BUT FAILED AND FINALLY MANAGED TO CLOSE AT 5939. IT IS CLEARLY VISIBLE THAT ON A DAILY CHART NIFTY IS FORMING H&S PATTERN AND FINDING GOOD SUPPORT AROUND IT NECKLINE AREA OF 5910. AS PER OPTION CHAIN STILL 5900 PE IS HAVING HIGHEST OI . LIQUIDATION IS SEEN IN 6000 PE AND OI WAS BUILT UP 6000 CE. THOUGH THE DIFFERENCE OF TOTAL OI AT 6000 CE AND 6000 PE IS NEGLIGIBLE. CONSIDERING THE OPTIONS DATA AND OVERSOLD POSITION IN CERTAIN INDEX MAJORS NIFTY MAY CONSOLIDATE IN A RANGE OF 5900-6000 OR WE MIGHT WITNESS TECHNICAL BOUNCE BACK FROM HERE.

SUPPORT 5910-5880

RESISTANCE 5980-6011

Sunday 2 June 2013

NIFTY UPDATES 2613

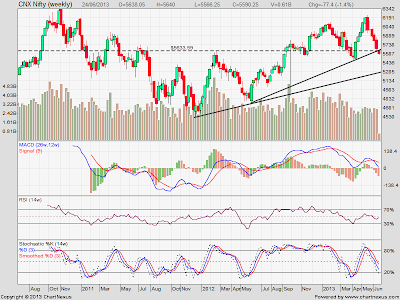

FOR THE LAST TWO MONTHS MARKETS ARE MOVING LIKE ANYTHING. IN APRIL NIFTY KISSED 5477 LEVEL AND RECOVERED SHARPLY AND POSTED HIGH OF 6229 IN THE MONTH OF MAY. ON THE EXPIRY DAY IT GAVE A VERY POWERFUL CLOSE AT 6124 AND ON THE NEXT SESSION IT GAVE A VERY SHARP CORRECTION OF 138 POINTS. ON A DAILY CHART NIFTY JUST MANAGED TO HOLD 5974 LEVEL ON A CLOSING BASIS. ON A WEEKLY CHART IT FORMED A DOJI PATTERN. AS PER OPTION CHAIN 6000 PE IS HAVING HIGHEST OPEN INTEREST OF 55.16 LAC. 5900 PE IS HAVING OI OF 51.45 LAC WITH ADDITION OF MORE THAN 10 LAC. HIGHEST OI BUILT UP AT 6100 CE OF 11.68 LAC. 6200 CE IS HAVING HIGHEST OI OF 42.58 LAC. VIX CLOSED AT 16.99.

Subscribe to:

Posts (Atom)